Banking Giants & Climate Action

The power to mobilize trillions of dollars towards any initiative lies only with banking and financial institutions, especially in our goal toward net-zero transitions. This is why what these institutions do and encourage has a major impact on achieving the climate action goals. The banking giants have the competence to unlock any finance required to help achieve the global transition to net-zero - from funding and backing pioneering firms to investing ethically and in technologies that help build resilient and transformative economies.

How can banks help us?

Despite The Paris Agreement, several of the world's largest commercial and investment banks have collectively invested approximately $3.8 trillion into fossil fuel clients in the years 2016-2020. Fossil fuel financing is detrimental to the climate action proposition and undermines the efforts and actions of several institutions toward achieving the net-zero goal.

The Banking on Climate Chaos 2021 is a valuable report developed by a group of reputable non-profits using Bloomberg’s league credit methodology, Global Coal Exit List, and Bloomberg Finance data. This expansive report provides a perfect opportunity for banks and financial institutions to evaluate and assess their financing and policies.

Additionally, efforts toward net-zero transition matter and are influential. HSBC recently announced its “phase down” with any fossil fuel client investments. They believe in engaging their clients in clean green practices and provide appropriate financing & advisory solutions regarding the same.

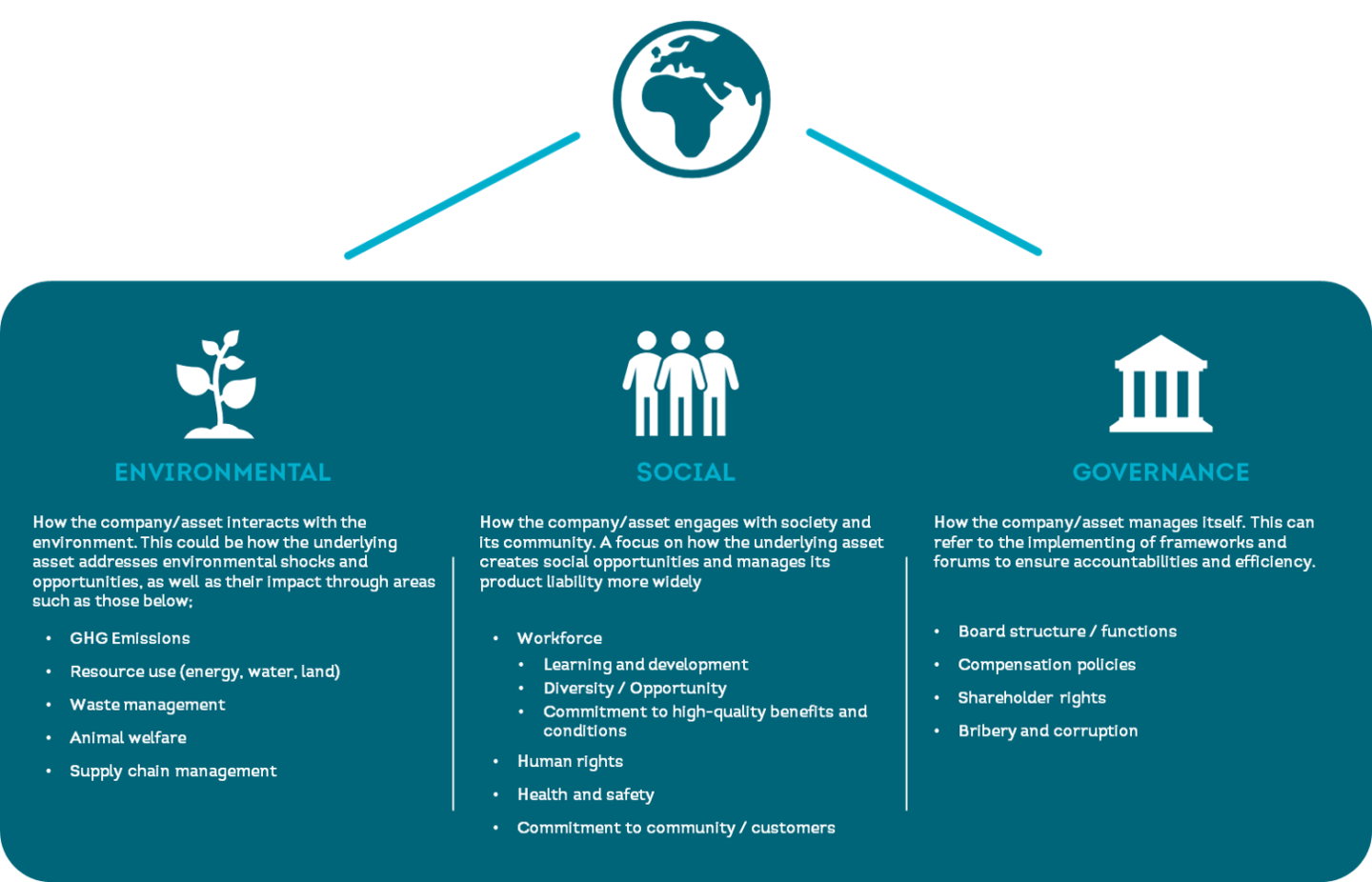

The Big Six of Canada - BMO, TD, RBC, CIBC, Scotiabank, and National Bank of Canada - all pledged to join the Net-Zero Banking Alliance (NZBA) for a global sustainable banking sector. This step promotes efficient capital allocation and responsible investments which can prove to be a game-changer in the net-zero transition. Such alliances will also reconstruct and transform the business environment, which contributes significantly to the climate crisis. Clean green investments are also an important factor in determining the ESG proposition of the firms.

Big climate promises today for bigger returns tomorrow!

Hi Sriya, I actually focused on a similar topic regarding the Canadian Big 5 banks and ESG commitments (you should check it out, hehehe)! What I've found is that these banks are willing to make these commitments on paper, but as they hold so much capital, they're given extra leniency when it comes to evaluating actions. All of the Big 5 actually signed a a billion dollar deal with Keystone to act as debtors. Even though these banks say that they will encourage Keystone to be accountable for ESG issues, there's nothing less environmentally friendly than increasing fossil fuel production.

ReplyDelete